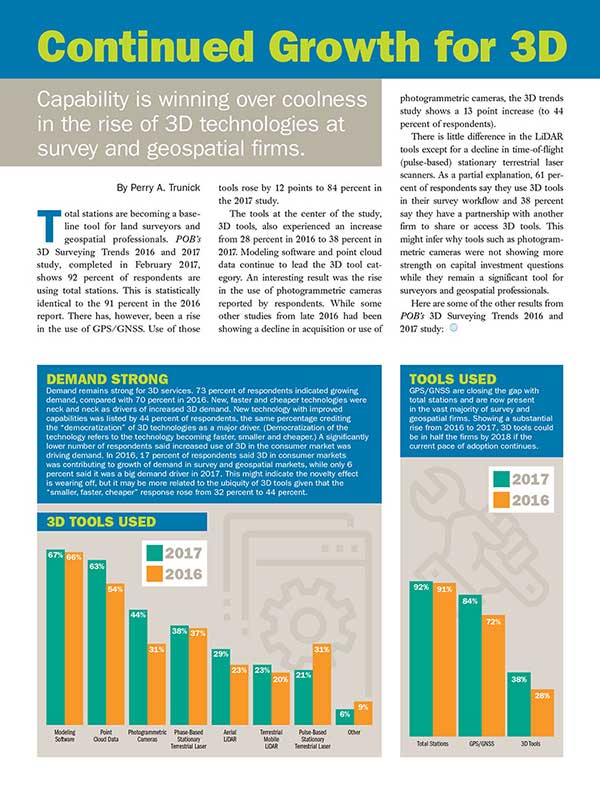

Total stations are becoming a baseline tool for land surveyors and geospatial professionals. POB’s 3D Surveying Trends 2016 and 2017 study, completed in February 2017, shows 92 percent of respondents are using total stations. This is statistically identical to the 91 percent in the 2016 report. There has, however, been a rise in the use of GPS/GNSS. Use of those tools rose by 12 points to 84 percent in the 2017 study.

The tools at the center of the study, 3D tools, also experienced an increase from 28 percent in 2016 to 38 percent in 2017. Modeling software and point cloud data continue to lead the 3D tool category. An interesting result was the rise in the use of photogrammetric cameras reported by respondents. While some other studies from late 2016 had been showing a decline in acquisition or use of photogrammetric cameras, the 3D trends study shows a 13 point increase (to 44 percent of respondents).

There is little difference in the LiDAR tools except for a decline in time-of-flight (pulse-based) stationary terrestrial laser scanners. As a partial explanation, 61 percent of respondents say they use 3D tools in their survey workflow and 38 percent say they have a partnership with another firm to share or access 3D tools. This might infer why tools such as photogrammetric cameras were not showing more strength on capital investment questions while they remain a significant tool for surveyors and geospatial professionals.

Here are some of the other results from POB’s 3D Surveying Trends 2016 and 2017 study:

Demand Strong

Demand remains strong for 3D services. 73 percent of respondents indicated growing demand, compared with 70 percent in 2016. New, faster and cheaper technologies were neck and neck as drivers of increased 3D demand. New technology with improved capabilities was listed by 44 percent of respondents, the same percentage crediting the “democratization” of 3D technologies as a major driver. (Democratization of the technology refers to the technology becoming faster, smaller and cheaper.) A significantly lower number of respondents said increased use of 3D in the consumer market was driving demand. In 2016, 17 percent of respondents said 3D in consumer markets was contributing to growth of demand in survey and geospatial markets, while only 6 percent said it was a big demand driver in 2017. This might indicate the novelty effect is wearing off, but it may be more related to the ubiquity of 3D tools given that the “smaller, faster, cheaper” response rose from 32 percent to 44 percent.

Tools Used

GPS/GNSS are closing the gap with total stations and are now present in the vast majority of survey and geospatial firms. Showing a substantial rise from 2016 to 2017, 3D tools could be in half the firms by 2018 if the current pace of adoption continues.

Driving Demand

Technological improvements are helping to drive growth in the use of 3D tools. Topographic mapping and construction remain top applications, but show significant rises in demand while “industrial” applications have begun to drop.

Acquisitions Follow Applications

Planned purchases of 3D tools follow the patterns of the tools already in use or rising in use. Acquisitions of modeling software among users showed an increase from 17 percent in 2016 to 26 percent in 2017, and point cloud data tools showed a strong increase from 8 percent in 2016 to 21 percent in 2017. Current non-users continue a slow adoption of 3D technologies.

Education and Training

The knowledge gap may be closing a little. Users of 3D technologies report a slightly better response by professional societies and universities, but the majority still “strongly disagree” or “somewhat disagree” with positive statements about training and education.