This year, when POB and BNP Market Research conducted the 3D Surveying Trends 2017 and 2018 study, a couple of numbers stood out and demanded a closer look. While the numbers weren’t anything that would cause a wide swing in the overall results, they do offer some pointed insights.

Though the study asked if respondents used total stations, GPS/GNSS and 3D tools, the focus is on 3D tools such as LiDAR, photogrammetric cameras, and supporting technologies. (Incidentally, 91 percent of respondents use total stations and 85 percent GPS/GNSS). Those numbers were nearly identical from 2017 to 2018.

But this is where things get interesting. Deep in the demographic profile of respondents for 2018, the numbers showed a spike among respondents with 10 years or less of industry experience. Specifically, the three-to-10-year band for users of 3D tools jumped from 9 percent in 2017 to 21 percent in 2018. When the category “users of 3D tools” was cross-tabbed against experience, those with 10 years or less of industry experience accounted for 52 percent of respondents vs. 29 percent with over 10 years of experience. This prompted a closer examination of user responses throughout the study.

Most of the 2018 results follow the demonstrated trends of increased use of 3D tools, tools used and planned purchases. There are a couple of places where the “10 years and under” responses vary significantly from their counterparts. A single data point won’t yield conclusive evidence of a trend, so the 2018 results will have to be viewed in a larger context with other studies, and again, when the 3D study is repeated. For now, the data add an interesting spice to the mix. Descriptions accompanying the following tables and graphs include commentary where the responses of the 10-years-and-under group differ significantly from the rest of the respondents.

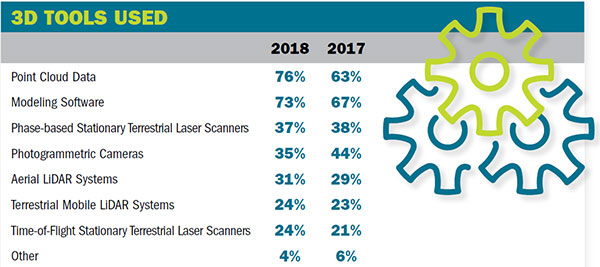

3D Technologies Used in Surveying and Mapping

Among users of 3D tools, point cloud data and modeling software continue to top the list. The demographic mix of users responding to the 2018 study showed a majority (52 percent) who said they had 10 years or less of industry experience.

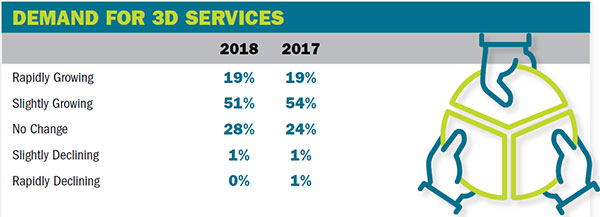

Growth in Demand for 3D Surveying Services

Perceptions among respondents continue to support growth in the demand for 3D services. Though the overall perceptions track closely from 2017 to 2018, 39 percent of the respondents with 10 years or less said demand was growing rapidly, while 14 percent of those with over 10 years of experience indicated rapid growth.

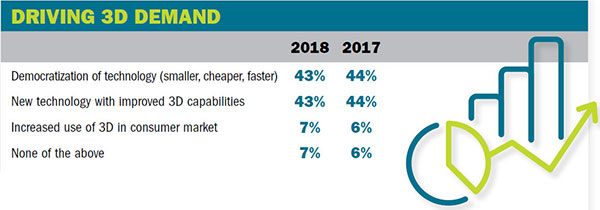

Drivers in Demand for 3D Surveying Services

What’s driving demand for 3D services? Almost without variation, advances in technology is the answer – from smaller, faster, and cheaper gear to improvements in capabilities.

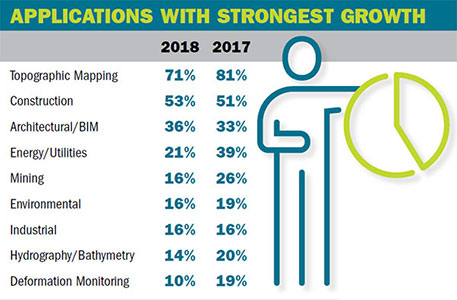

Applications of 3D Technologies

Topographic mapping and construction remain at the top of the growth list when it comes to demand for 3D tools, but respondents with 10 years or less of experience reported significantly higher growth in mining and environmental applications than their counterparts. In both cases, 31 percent vs. 13 percent.

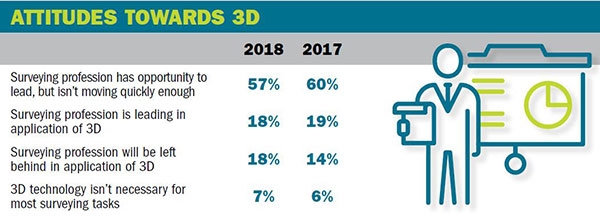

Views on Offering 3D Surveying Services

Though 30 percent of non-users don’t see the necessity for 3D services in surveying, the users suggest the profession isn’t moving fast enough in the adoption and use of the technologies. Newer professionals are more optimistic. Among those with 10 years or less of industry experience, 42 percent say the surveying profession is leading in the application of 3D. This compares with just 12 percent of their more senior counterparts who say surveying is leading the way.

Training in 3D Tools

Consistently, just over one-third of 3D users took some form of training in the past year – this nearly matches the number of non-users who plan to take training in 3D tools. Over half of users plan to take training next year.

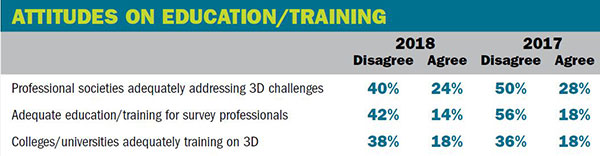

Attitudes on Education and Training

Training is important when technologies are changing and demand is growing. Attitudes are still strong among users that training is generally inadequate. Even among the 10-years-or-less group, colleges and universities are not seen as providing adequate training in 3D (67 percent vs. 32 percent of those with over 10 years of experience who join that view). Running slightly counter to that view, 33 percent of 10-years-or-under respondents among non-users of 3D tools feel colleges and universities do an adequate job while only 2 percent of the non-users with over 10 years of experience feel the same.

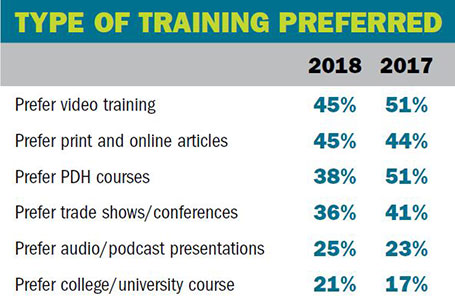

Training Preferences

Training preferences may be one area where the increased number of respondents with less than 10 years of experience has an impact. The pairing of video training and PDH courses from 2017 shifts to video and print/online articles in 2018. A small increase in those preferring college or university courses for training masks a deeper split. Here, the responses of those with 10 years or less of experience clearly outweigh those of their counterparts with 56 percent of the younger group preferring college training vs. 12 percent of their counterparts.

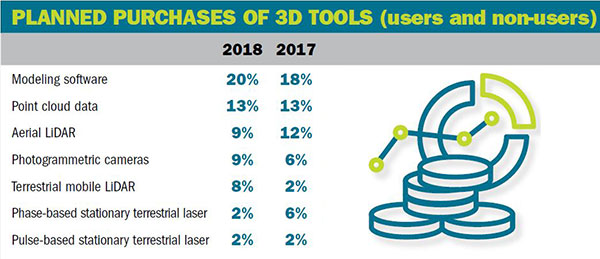

Investing in 3D Tools for Surveying and Mapping

Among users and nonusers of 3D tools, most purchases planned in the next 12 months are for modeling software and point cloud data. Aerial LiDAR and terrestrial mobile LiDAR appear to be eroding phase-based laser purchases, while photogrammetric cameras get a bit of a bump.

Please visit to purchase and download the entire report as well as access a wide inventory of other studies done in this industry. You can also email us at if you have any questions.