If you’re happy and you know it, you must be a surveyor. It’s hard to imagine the already-high job satisfaction number for surveyors could go up, but it did. It takes a little more digging to see that earning potential is headed in the same direction. Based on the type of firm and the type of work performed, most of the news is good. A stronger economy is starting to deliver some benefits along with the promise of more. Balancing the challenges and opportunities is the order of the day.

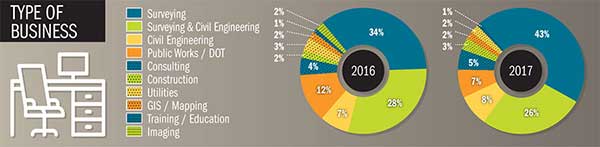

POB’s 2017 Salary and Benefits Study was conducted in the early months of 2017 and resulted in a slightly larger response over prior years. While this wasn’t enough to skew results, the base did show some subtle shifts. There was an increase in the number of respondents reporting they work for survey firms (up 9 percent from 2016) and a slight dip in the number who report they work for civil engineering/survey firms (down 2 percent). When combined with “civil engineering” the responses accounted for over three quarters of the firms vs. 69 percent in 2016. Some of this may be the result of fewer responses from public works/DOT, which exhibited an unusual four-year pattern of reaching 12 percent of respondents in 2016 and dropping to 7 percent in 2017; almost exactly matching the two prior years (11 percent in 2014 and 7 percent in 2015).

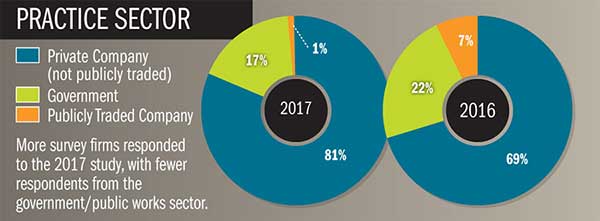

With a rise in the number of survey firms over multi-discipline firms, it is not surprising to note an increase in the number of privately held companies represented vs. publicly traded firms or government surveyors.

The leading types of work performed have not changed. Boundary surveys, GPS surveys, construction surveys, and cadastral or topographic surveys making up the top four types of work reported by over two thirds of respondents. Civil engineering has maintained its position at number five, with 57 percent of respondents saying they perform civil engineering functions. Interestingly, this category has continued to see a 1-percent-per-year drop in each of the last four years covered by the report.

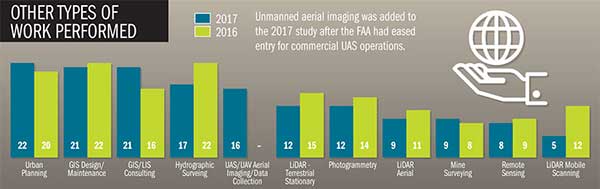

Most other types of work continue to fall in a range of a couple of percentage points up or down from 2016 except for cartography/map making which rebounded to 37 percent from 27 percent in 2016. Since that is roughly where it appears for three of the four years, the 2016 drop was likely an anomaly based on the mix of respondents in 2016.

One fifth of respondents perform GIS and LIS functions. These two areas have remained relatively consistent, with a slight increase in GIS/LIS consulting.

A new addition to the study was UAS aerial imaging and data collection. There is no data from 2016 for comparison. The category was added following the Federal Aviation Administration rule changes, which eased entry into commercial unmanned aerial systems (UAS or drone) operations. There was very little change in aerial LiDAR or photogrammetry between the 2016 and 2017 studies.

The People Side of the Business

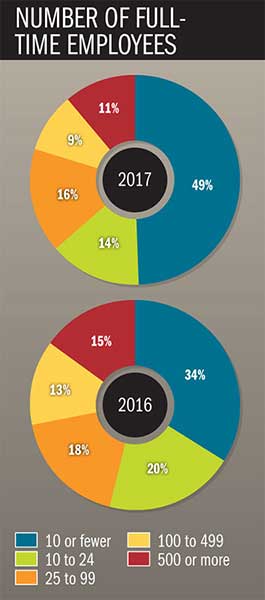

One consequence of the high proportion of privately held survey firms covered in the study is reflected in company size. Just under half of the firms report 10 or fewer employees. That’s a significant increase from 2016 when 34 percent said they employed 10 or fewer people. As POB observed in 2016, there was an increase in the number of government responses in that year and a higher number of publicly traded firms reporting (7 percent of the total in 2016 vs. 1 percent in 2017).

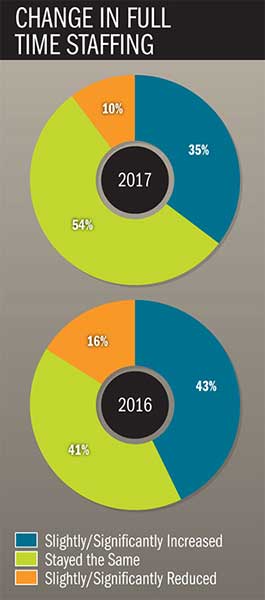

Paired with those results, when asked about changes in company size, a smaller number reported the number of employees decreasing. Most companies remained at the same size (54 percent), while over a third added to staff (35 percent). With the rounding error accounted for, that leaves 10 percent who actually reduced their workforce. This is an improvement over the 16 percent who reduced staff in 2016 and the 13 percent in 2015. Indications are that increases came in each company size category, with larger companies reporting increases more often than smaller firms. Still, 15 percent of the smallest firms reported adding staff while half to two thirds of their larger counterparts reported adding employees. The highest reported staff reductions were in the largest firms.

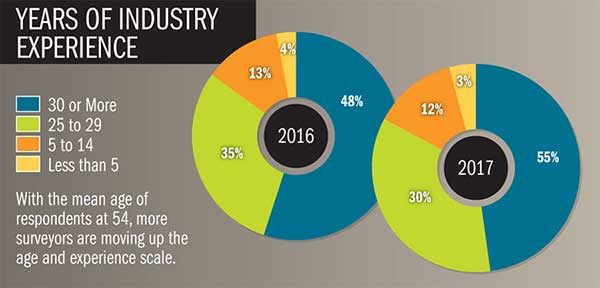

Age and experience continue to be unevenly distributed at the upper end of the scales. Those reporting 30 or more years of industry experience topped 50 percent for the first time. This appears to be a shift of experienced surveyors topping the 30-year mark, judging by the corresponding drop in the 15-29-year group. The sample varies from year to year based on who participates, but the drop in the 15-29-year group is not one-to-one with the rise in the 30+ group, suggesting some of the 5-14-year group have graduated into the next category as well. The mean age of respondents increased by one year to 54.

Dollars and Cents

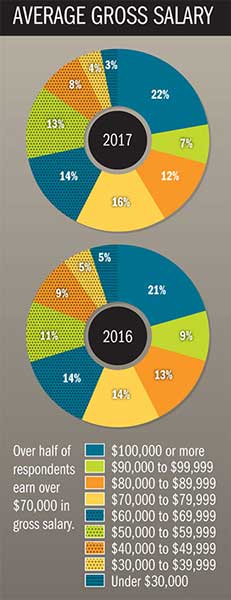

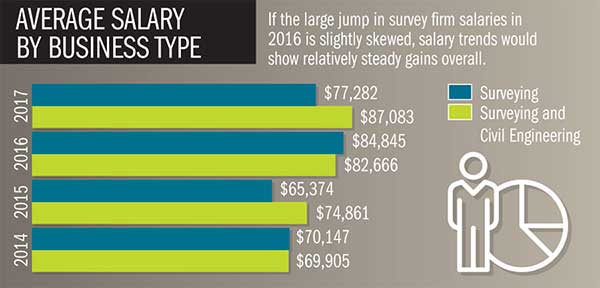

Compensation trends show essentially no change in the number of respondents reporting full-time, salaried employment. Similarly, wages are consistent with 2016 with 41 percent of respondents earning over $80,000 per year as compared with 43 percent in 2016. Another 43 percent earn $50,000 to $79,999, up from 39 percent in 2016. Salaries appear to have increased in companies offering both surveying and civil engineering services, though the increase in the average is less than $5,000. Perhaps more troubling is the indication the average of salaries in survey firms dropped by $7,500. However, when compared with 2015, the $84,845 reported average in 2016 is a spike of nearly $20,000, so the reality may be more of a steady improvement from $65,374 in 2015 to $77,282 in 2017.

Steady improvement may be the better answer given that 85 percent of respondents said their salaries remained about the same or rose slightly in the prior two years (full calendar years reported). That tracks with the 81 percent result in 2016. In fact, five years of data reflect similar results.

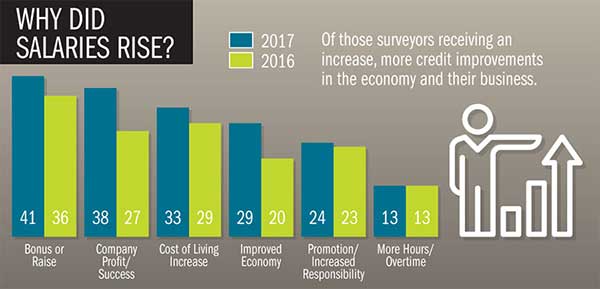

For those who received an increase, the dominant form was a bonus (41 percent of respondents). In another part of the study, 63 percent cited a bonus as part of their compensation/benefits package and 32 percent listed profit sharing.) Driving salary increases and bonuses is increased company profitability, based on a significant increase in those reporting company profit contributed to their salary increase. While about a third of respondents cited a cost-of-living increase and about a quarter said they received a promotion or took on added responsibilities in both the 2017 and 2016 studies, an improved economy and company profit spiked a bit. In the 2016 study, 20 percent of respondents said an improved economy helped drive their increase and 27 percent said company profit was a driver. For the 2017 study, those responses were 29 percent and 38 percent, respectively. At a roughly 10 percent increase in reporting, that would make the improved economy and profit some of the strongest drivers for increases.

On the side of decreases, where only a small number (6 percent) were reporting, less work and a slower economy were top drivers.

It’s difficult to conclude from two years of data that benefits have decreased. The question was changed in 2016, so the answers don’t compare beyond two years. Looking at the benefits packages for the 2017 study, 75 percent offer health insurance and over half offer dental insurance and life insurance. Vision insurance is part of 45 percent of packages.

Most insurance benefits are at least partially paid by employees. Just over one quarter of employers fully pay for health insurance.

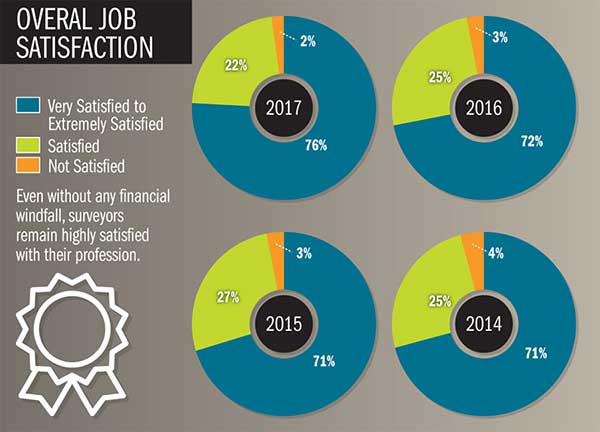

When all of the factors are weighed, the clincher comes down to job satisfaction. Here, surveyors always account for the age and experience curves by reporting extreme job satisfaction. Those who report at the top of the satisfaction scale represent just over three quarters of respondents. After trending at 70 percent or 71 percent for three years, the number bumped up to 76 percent in the 2017 study and the number reporting they were not satisfied dropped to just 2 percent, leaving 22 percent moderately happy.

Sidebar: Expanding, Meeting Challenges

Any study will yield quantifiable and qualitative results. No one would dispute that the numbers are important in comparing results, looking for trends, and just getting a rock-solid view of what is happening. The charts and tables are great for seeing where change is occurring and where we are holding our ground. But, the verbatim comments offer a different insight. Without a pile of numbers to support them, here are some observations based on a large number of verbatim comments.

When it comes to making changes to address business conditions, respondents to POB’s Salary and Benefits Study offered the following:

- Adding or upgrading technology or equipment.

- Adding capabilities – unmanned aerial systems, hydrography, CAD and other post processing, and expertise in new service areas.

- Increasing marketing and outreach efforts, more community involvement and charitable donations to build name awareness.

- Identifying new market opportunities (DOT, construction, etc.) and adding staff/expertise.

- Increased training/education.

And, for those responding to downturns, cutting staff, hours, benefits, etc.

Challenges weren’t limited to business conditions, nor were the responses companies had to the challenges they face. Age, ageing equipment, budget constraints, and collections were frequently mentioned.

Competition had many complexions. In addition to competition with other qualified surveyors, respondents said they faced unqualified or unlicensed competitors and competitors who were described as “cut rate” or not upholding standards and practices of the profession.

Finding good, qualified workers or partners was another regular challenge.

Technology has been helpful, often allowing more to be done with fewer workers, but for many the technology is still difficult to cost justify. (The good news from recent trade shows is that manufacturers are addressing this.) Keeping up with technology and training for its use also come up. But, despite it all, respondents are optimistic and see more positive things coming from technology. The rise of 3D imaging, LiDAR developments, better GPS, better satellite imaging, unmanned aerial systems (UAS-drones), and more robotic systems are among the long list of technologies expected to have an impact on surveying.

Looking for success? Respondents offered a very long list of recommendations. Some of the top suggestions include acting professional and pricing accordingly, education and training, outreach and community involvement, train and mentor, and keep up with technology.